Future Contract¶

Overview¶

Future is a version of derivatives product.

Future included by following component:

flowchart LR

%% Component

subgraph derivative[Derivative]

subgraph future[Future]

index_future[Index Future]

bond_future[Bond Future]

end

end

subgraph underlying_asset[Underlying Asset]

index[Index]

government_bond[Government Bond]

end

%% Flow

index_future --- index

bond_future --- government_bondFor Vietnam market, following is underlying of asset:

| Underlying asset | Detect Code |

|---|---|

| Government Bond | GB5Y, GB10Y |

| VN30 Index | VN30 |

Government Bond Future¶

| No. | Provision | Description |

|---|---|---|

| 1 | Contract name | 5-year Government Bond Futures |

| 2 | Contract code | According to trading code introduced by VNX |

| 3 | Underlying asset | |

| 4 | Contract size | VND 1 billion |

| 5 | Multiplier | 10,000 |

| 6 | Listing date | 04/07/2019 |

| 7 | Trading method | Order matching and Negotiation |

| 8 | Expiry month | Three last months of three nearest quarters |

| 9 | Trading time | Open 15 minutes prior to the underlying market .Close in tandem with the underlying market |

| 10 | Tick size | VND 01 |

| 11 | Trading unit | 01 contract |

| 12 | Reference price | Daily settlement price of the previous trading day or theoretical price (on the first trading day) |

| 13 | Trading collar | ± 3% |

| 14 | Order limit | 500 contracts per order |

| 15 | Position limit | Regulated by VSD |

| 16 | Final trading day | The fifteenth day of the expiry month. In case it is a holiday, it will be the previous trading day. |

| 17 | Final settlement day | The third working day after the final trading day |

| 18 | Settlement method | Physical settlement |

| 19 | Daily settlement price | Regulated by VSD |

| 20 | Final settlement price | Daily settlement price of final trading day |

| 21 | Criteria of deliverable bonds | Government Bonds issued by Vietnam State Treasury |

| 22 | Margin requirement | Regulated by VSD |

5-year Government Bond, par value: VND 100,000, coupon: 5%/year, periodic interest payment at the end of every 12-month period, one-time principal payment at maturity date

, with remaining maturity from three to seven years on final settlement day, with the minimum of VND 2,000 billion in listing value. Conversion factor is calculated on the basis of coupon (5% per year).

VN30 Future¶

| No. | Provisions | Descriptions |

|---|---|---|

| 1 | Contract name | VN30 index future |

| 2 | Contract code | According to trading code introduced by VNX |

| 3 | Underlying asset | VN30 index |

| 4 | Contract size | VND 100,000 × VN30 Index point |

| 5 | Multiplier | VND 100,000 |

| 6 | Listing date | 10/08/2017 |

| 7 | Trading method | Order matching and Negotiation |

| 8 | Expiry month | Current month, next month, 2 end months of the next 2 quarters. |

| 9 | Trading time | Open 15 minutes prior to the underlying market. Close at the same time as the underlying market |

| 10 | Tick size | 0.1 index point |

| 11 | Trading unit | 01 contract |

| 12 | Reference price | Daily settlement price of the previous trading day or theoretical price |

| 13 | Trading collar | ±7% |

| 14 | Order limit | 500 contracts per order |

| 15 | Position limit | Regulated by VSD |

| 16 | Final trading day | The third Thursday of the expiry month. In case it is a holiday, it will be the previous trading day |

| 17 | Final settlement day | The working day after the final trading day |

| 18 | Settlement method | Cash settlement |

| 19 | Daily settlement price | Regulated by VSD |

| 20 | Final settlement price | Simplified arithmetic value of the index in the last 30 minutes of the last trading day |

| 21 | Margin requirement | Regulated by VSD |

| 22 | Trading fee | Regulated by Ministry of Finance |

y (including 15 minutes of continuous order matching and 15 minutes of post-trading periodic order matching), having ruled out three highest index values and three lowest ones of the continuous order matching.

For example: current month is April. Expiry months are April, May, June and September. |

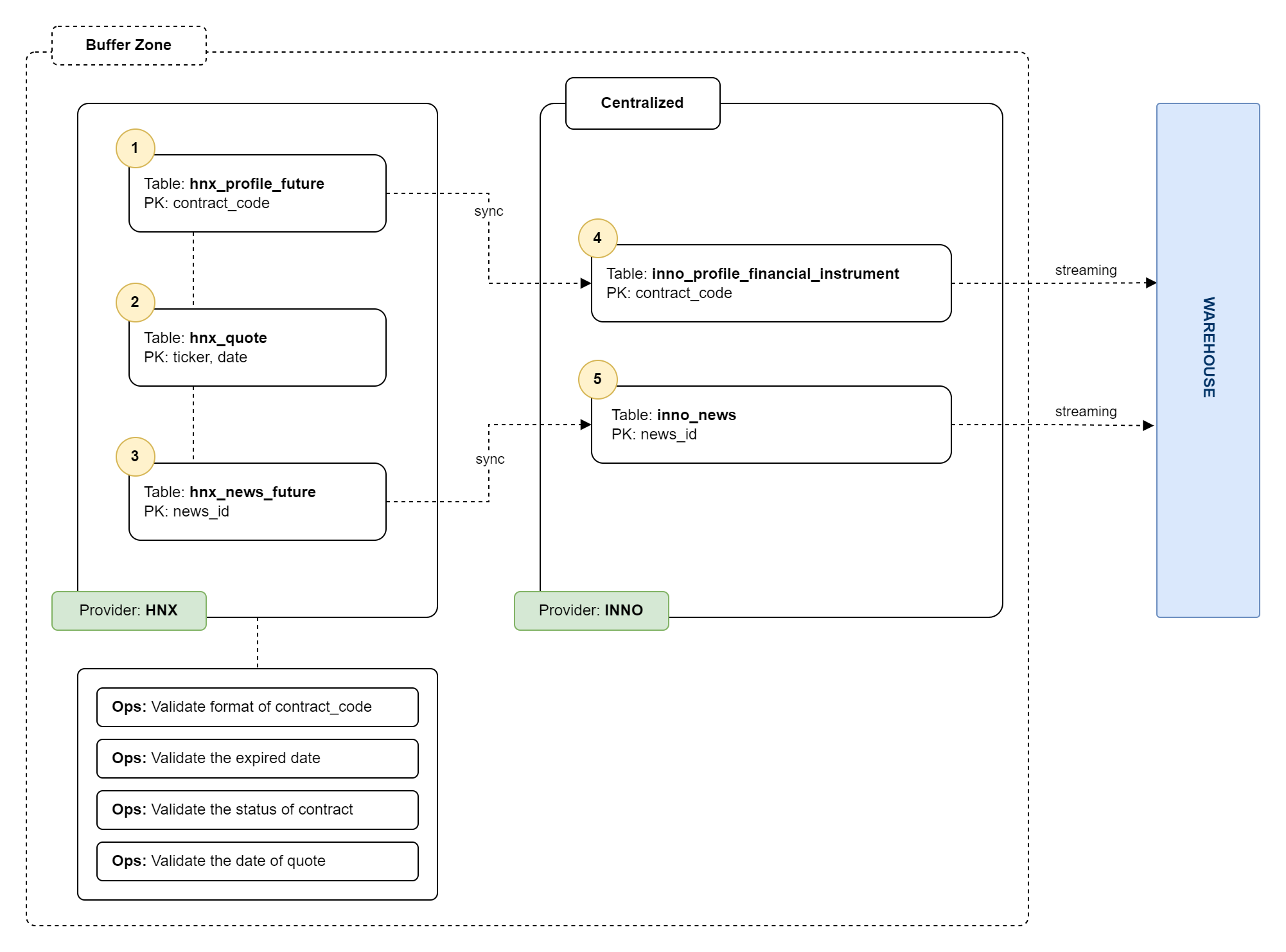

Entity–relationship model¶

Model¶

The model of future has been declared like follow

Table: hnx_profile_future¶

Table: hnx_profile_future

Description: contain the profile of future (one of derivative)

| Column | Type | Nullable | Name |

|---|---|---|---|

| contract_name | String | False | Contract name |

| contract_code | String | False | Contract code |

| underlying_asset | String | False | Underlying asset |

| contract_size | String | True | Contract size |

| multiplier | String | True | Multiplier |

| listing_date | String | True | Listing date |

| trading_method | String | True | Trading method |

| expiry_month | String | True | Expiry month |

| trading_time | String | True | Trading time |

| tick_size | String | True | Tick size |

| trading_unit | String | True | Trading unit |

| reference_price | String | True | Reference price |

| trading_collar | String | True | Trading collar |

| order_limit | String | True | Order limit |

| position_limit | String | True | Position limit |

| final_trading_day | String | True | Final trading day |

| final_settlement_day | String | True | Final settlement day |

| settlement_method | String | True | Settlement method |

| daily_settlement_price | String | True | Daily settlement price |

| final_settlement_price | String | True | Final settlement price |

| criteria_of_deliverable_bonds | String | True | Criteria of deliverable bonds |

| margin_requirement | String | True | Margin requirement |

Map on financial instrument

| Column | Type | Nullable | Name |

|---|---|---|---|

| contract_name | String | False | Contract name |

| contract_code | String | False | Contract code |

| underlying_asset | String | False | Underlying asset |

| contract_size | String | True | Contract size |

| multiplier | String | True | Multiplier |

| listing_date | String | True | Listing date |

| trading_method | String | True | Trading method |

| expiry_month | String | True | Expiry month |

| trading_time | String | True | Trading time |

| tick_size | String | True | Tick size |

| trading_unit | String | True | Trading unit |

| reference_price | String | True | Reference price |

| trading_collar | String | True | Trading collar |

| order_limit | String | True | Order limit |

| position_limit | String | True | Position limit |

| final_trading_day | String | True | Final trading day |

| final_settlement_day | String | True | Final settlement day |

| settlement_method | String | True | Settlement method |

| daily_settlement_price | String | True | Daily settlement price |

| final_settlement_price | String | True | Final settlement price |

| criteria_of_deliverable_bonds | String | True | Criteria of deliverable bonds |

| margin_requirement | String | True | Margin requirement |

Futher Reading¶

- [1] Introduction of profile for security